For Employers

Your Strategic Advantage in an Ever-Changing Environment

Retirement Plan Consulting Services

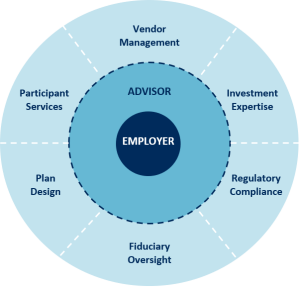

How We Work With You

We are dedicated to:

•Creating a reliable, seamless experience and improved outcomes for retirement plan sponsors and employees

•Implementing process-driven strategies to help you limit your fiduciary liability

•Acting as your guide to help you manage changes in the regulatory environment

•Offering advice and education to improve the retirement readiness of your employees

•Helping you manage your relationships with third parties

How We Are Different

Our objectives are aligned with your best interests and those of your employees.

•An impartial viewpoint

•Investment advice and selection free from proprietary product constraints

•A fully transparent fee structure

•Objective vendor and investment recommendations

•We're committed to standards of investment fiduciary excellence

The Newton Financial Solutions Advantage

Our primary goal is to help you manage risks, ensure that your plan delivers optimum investment options and services, and improve employee retirement readiness.

Designing a Plan to Help Maximize Satisfaction

We focus on designing a plan that can streamline your administrative responsiblities, maximize plan provisions, and promote employee satisfaction.

Plan Design:

Employer contribution modeling and analysis

Review of plan eligibility and distribution provisions

Optimal use of “safe harbors,” such as 404(c) and default alternatives

Compliance with legislative and regulatory changes

Vendor Management and Due Diligence:

Ongoing fee benchmarking and analysis against other vendors and plans

Vendor search services, including:

- Gathering responses, data, and pricing from several plan providers

- Analyzing costs, services, and investment choices

- Facilitating finalist meetings

Helping Your Employees Make Better Decisions

We provide advice and education to help your employees understand plan options, encourage participation, promote satisfaction, and feel confident about the decisions they are making toward their retirement readiness.

- Employee education program tailored to your specific needs

- Semiannual employee education meetings, including enrollment meetings and broad financial planning education

- Individualized investment advice

- Effective use of online tools and resources

- Ongoing assessment to track progress and measure results